Compliance Management in Regulated Industries:

Everything You Need to Know

- Modern Requirements

- March 11, 2025

- 9 minutes

Just as people need to obey the rules of the country they live in, so must businesses follow strict rules and regulations defined by governments to operate legally and ethically. These regulations ensure safety, data security, and fairness; but keeping up with them can be overwhelming. A single mistake can lead to fines, legal trouble, or reputational damage.

With the growing complexity of regulations, businesses are turning to technology for help. Automated tools and structured processes make it easier to manage compliance without disrupting daily operations.

In this blog, we’ll explain what compliance management is, its importance in regulated industries like finance and healthcare, etc., and provide a step-by-step guide to simplify the process.

Table of Contents

Understanding Compliance Management in Regulated Industries

Compliance management in regulated industries is the ongoing process of monitoring and tracking systems to ensure that businesses always meet legal and regulatory standards.

It is not just about following rules specified by entities like government bodies, regulatory bodies, or industry standards. However, it is about having a clear process that helps companies keep track of what they must do and how they should proceed to do it.

In sectors like healthcare, finance, and energy, compliance is critical. If companies fail to meet these standards, they need to pay hefty fines and face legal issues.

A well-organized compliance management process helps businesses handle risks and stay ready for audits. Key aspects of this process include:

- Knowledge of the set of rules based on your business industry.

- Regular training on new or changed guidelines.

- Keeping records and maintaining them accurately and up to date.

- Monitoring and reporting any changes.

This structured approach not only meets legal requirements but also builds trust with customers and partners. Furthermore, documentation and traceability of every procedural step allow businesses to work seamlessly and be well-prepared for any inspections.

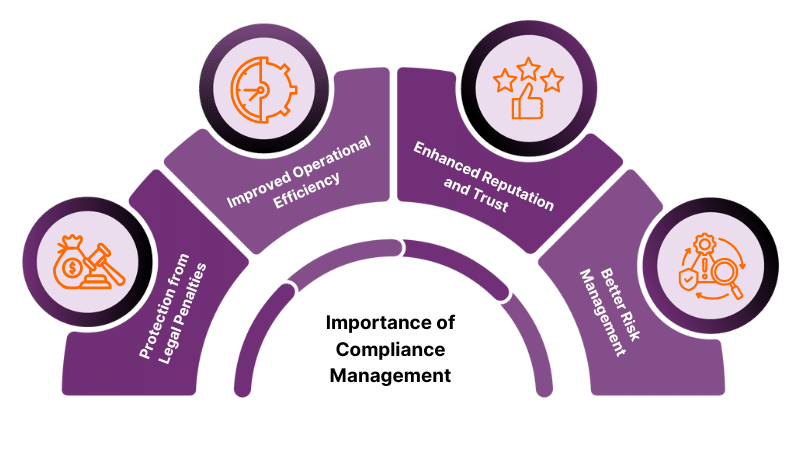

Why is Compliance Management Important?

As discussed previously, compliance management allows corporations to avoid fines, build trust, and run business operations without any legal issues. Essentially, it also reduces risks and saves money in the long term.

Below are four key reasons why compliance management is important for a business’s success:

Protection from Legal Penalties

Compliance management is most important in regulated industries where one mistake can lead to severe penalties. It helps organizations to avoid monetary fines and legal actions by ensuring they follow all required rules.

For example, Volkswagen once installed software in their diesel engine to meet the emission standards, but they were caught cheating in the lab. After that, they paid a multi-billion dollar fine in 2016 to settle everything. You can avoid such penalties with compliance management.

Improved Operational Efficiency

Having a clear compliance process is a boon for any organization. It streamlines daily operations by establishing smooth workflows and reducing delays.

With healthier implementation of the compliance, companies can be assured that they remain consistent in their management of various workflows.

Enhanced Reputation and Trust

Compliance with industry regulation gives organizations a good reputation in the market and trust with their clientele and partners. With regulatory compliance software in place, the company projects a trustworthy image in the market through transparency.

Better Risk Management

With compliance processes in place, companies can identify compliance concerns early, thus lowering the overall risk. By using automated systems, businesses can prepare for audits and regulatory checks without stress.

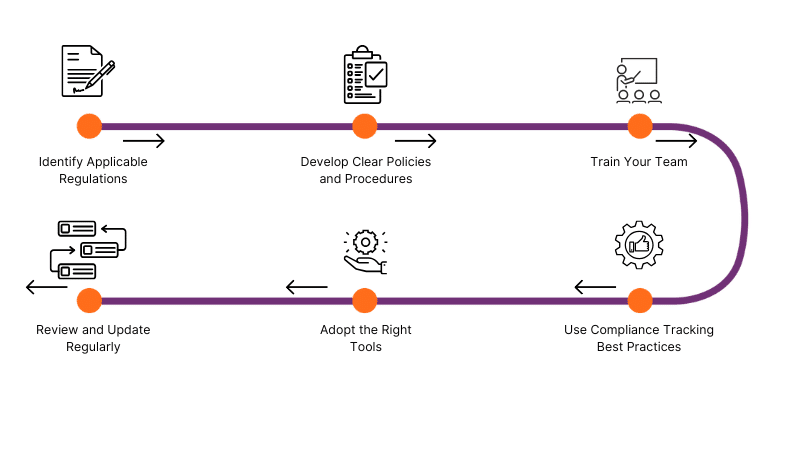

Implementing a Robust Compliance Management Process: A Step-by-Step Guide

To ensure that the company follows all regulatory requirements, implementing a well-structured compliance management process is a must. It also helps in determining the potential risks, implementing solutions, and continuously tracking industry regulations for improvements.

Follow the below 6-step guide to implement a solid compliance framework:

Step 1: Identify Applicable Regulations

The first step is to research all the regulations and laws that might affect your business.

Identifying relevant regulations and laws involves:

- Researching and collecting local, national, and, if needed, international regulations.

- Understanding industry-specific standards.

- Consulting legal experts or regulatory bodies.

For example, if you are running a healthcare business in the USA, you must follow HIPAA (Health Insurance Portability and Accountability Act) regulations.

However, you don’t need to be stressed about researching and collecting applicable regulations. AI-powered compliance management tools like Copilot4DevOps, a natively built-in solution within Azure DevOps, can collect all industry-specific regulations with a single click by just inputting your business details.

Step 2: Develop Clear Policies and Procedures

Clear compliance policies can save you from any legal issues. The next natural step, therefore, is to determine ways to implement them in your organization.

While drafting clear policies:

- Prepare well-written documents that contain guidelines for following each regulation.

- Outline step-by-step procedures for completing the particular tasks.

- Outline the roles and responsibilities of each team member.

- After drafting the policies, make sure that it is reviewed by the legal team.

Clear documentation ensures that every employee knows what is expected. A well-documented policy can help in avoiding non-compliance issues.

Step 3: Train Your Team

A compliance process is only as good as the people who follow it.

Organize regular training sessions to:

- Explain new and existing policies to each team member.

- Keep employees updated on regulatory changes.

- Solve doubts of employees regarding any policy or procedure.

For example, a financial services firm might hold quarterly workshops to ensure all employees understand the latest compliance risk management tools and procedures.

Step 4: Use Compliance Tracking Best Practices

Tracking your compliance activities is crucial for smooth operations.

Implement systems that allow you to:

- Monitor ongoing activities and flag potential issues.

- Keep detailed records of compliance efforts.

- Schedule regular internal audits to check for gaps.

Using these best practices helps maintain end-to-end traceability for compliance and makes it easier to prepare for external audits.

Step 5: Adopt the Right Tools

The fine for non-compliance can go up to millions, which can be 100x more than investing in the right compliance management tool. So, it is advisable to invest in the right compliance management tool as early as possible.

Look for solutions such as:

- Regulatory compliance software that keeps you updated on changes.

- Tools that offer automated reporting and record-keeping.

Software that allows for end-to-end traceability of compliance.

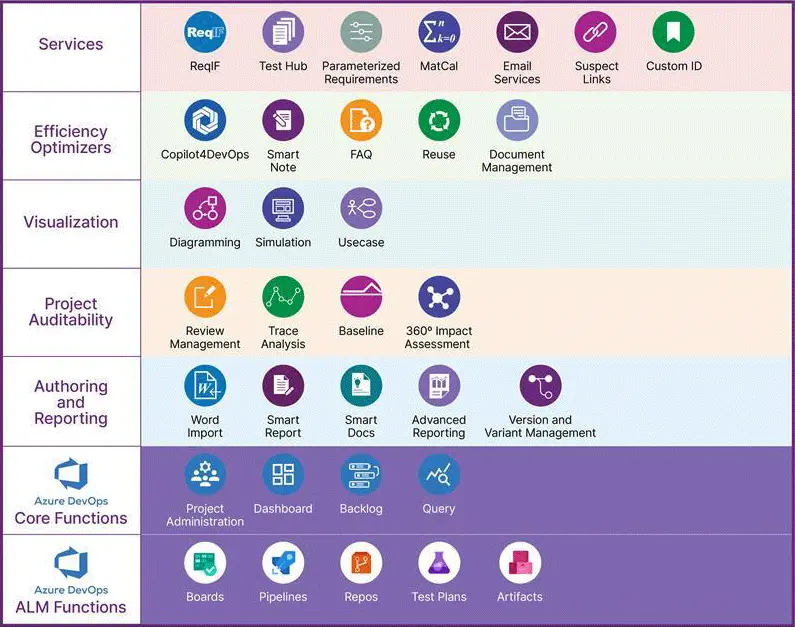

How Does Modern Requirements4DevOps Support Audit-Ready Compliance Management Within Azure DevOps?

Modern Requirements4DevOps is designed to support audit-ready compliance management by integrating powerful features directly within Azure DevOps. It offers a structured way to gather, manage, and prepare a report on regulatory requirements.

Key features of Modern Requirements4DevOps include:

- Copilot4DevOps: This is an AI-powered assistant that helps users to elicit the regulatory requirements. It also simplifies the process of updating and tracking regulatory changes.

- Smart Reports for Compliance Reporting: While choosing the compliance management tool, you must look for the automated reporting feature. The “Smart Report” feature of Modern Requirements4DevOps allows teams to generate customizable reports that are ready for audits. These reports make it easier to demonstrate that you are following the rules.

- Smart Docs for Creating Requirements Documents: This feature allows you to create well-structured documents for compliance policies and procedures in an MS Word-like interface. The reusable template allows you to create documents with the same structure. Furthermore, you can also use Copilot4DevOps to create and enhance well-structured documents using AI.

- Automated End-to-End Traceability for Compliance: Allows you to build horizontal and vertical traceability matrices to track every requirement from creation to implementation. It ensures that all changes in compliance are clearly visible and addressed properly.

- Version Control: This offers a robust version control feature to track different versions of regulatory compliance.

- Online Reviews: By using the “Online Reviews” feature offered by Modern Requirements4DevOps, you can send requests to your team members to review and approve compliance or documentation.

- Direct Integration Within Azure DevOps: Modern Requirements4DevOps is a built-in solution within Azure DevOps and stores all your information in Azure DevOps, ensuring that you have a single source of truth to store all of your compliance-related data.

With these features, Modern Requirements4DevOps makes it easier for organizations to maintain compliance while reducing manual work and potential errors. It is also aligned with popular industry standards, making this a simple, trusted tool.

Step 6: Review and Update Regularly

Compliance is not a one-time task since you always need to stay updated with it. Whatever worked yesterday might not be sufficient today. Schedule monthly or quarterly reviews for your compliance policies as part of your process.

When Conducting a Compliance Review:

- Review all policies and ensure that they still align with current regulations. If not, update them.

- Take feedback from your team and get updates on what works and what doesn’t.

- Make improvements based on audit findings and feedback.

- Update the outdated training material if required.

Regular reviews help maintain audit-ready compliance management and ensure your organization remains on track in a dynamic regulatory environment.

By following these 6 steps, you can develop a straightforward compliance management process that promotes resilience. In addition, such a process would save on costs in the long run while instilling consistency into your organization’s regulatory compliance.

Industry-Specific Compliance Standards: Ensuring Quality and Safety Across Sectors

Different industries operate under particular regulations to ensure safety, quality, and ethical practices. Below, we showcase some basic standards across industries:

1. Automotive Industry

- ISO 26262: The main focus of ISO 26262 is to ensure the functional safety of electrical and electronic systems in road vehicles. It minimizes the hazards caused by malfunctions and ensures that automotive components perform reliably under various conditions.

- ASPICE (Automotive SPICE): ASPICE, developed in 2005, provides a set of rules to develop and maintain software for different vehicles. By following ASPICE, vehicle suppliers can improve the quality of a vehicle’s software.

2. Healthcare and Medical Devices

- ISO 13485: This standard defines the requirements to manage the qualities of medical devices. It applies to the design, manufacturing, and installation of medical devices. For medical device manufacturers, ISO 13485 is very helpful to gain legal access to their product in the market.

- 21 CFR Part 11: Developed by the U.S. Food and Drug Administration (FDA), this standard ensures that electronic records and electronic signatures are trustworthy if they are created or modified using the 21 CFR part 11. This regulation applies to companies working in the pharmaceuticals, biologics, medical devices, and food products industries.

3. Information Technology and Services

- SOC 2: This standard is specifically designed for companies providing any kind of services. It defines a set of rules which ensures that companies manage customers’ data securely.

- ISO 9001: This standard is globally recognized. It demonstrates an organization’s ability to consistently provide products and services that meet customer and regulatory requirements.

Following these standards is very important for any companies working in regulated industries to improve operational efficiency, increase reputation in the market, and avoid penalties.

Challenges in Compliance Management

For any business, managing compliance is not easy, as it comes with its own set of challenges.

Here, we have explained a few challenges that you might face while managing compliance so you can be prepared for them.

- Staying Updated With Frequent Regulatory Changes: Industry regulations always keep changing, and tracking them is challenging. Also, companies are required to disrupt workflow to implement new regulations quickly and update documents.

- Complex Data Management: Handling and securing large volumes of records for audits can be tough without a proper compliance management system.

- Resource Intensive: Introducing compliance in an organization requires significant time, proper employee training, and heavy investments.

- Department Coordination: Ensuring clear communication across teams is essential, yet challenging.

- Manual Processes: Compliance management with outdated methods increases the chance of errors and delays.

- Compliance Culture: Fostering a strong company-wide commitment to ethical practices and continuous improvement remains an ongoing challenge.

To overcome these challenges, businesses can use a compliance management system that reduces manual efforts, improves data tracking, and ensures regulatory updates are implemented without disrupting daily operations.

You can use tools like Modern Requirements4DevOps to manage compliance without any challenges and focus on business growth rather than struggling with compliance complexities.

Closing Thoughts

Compliance management is a continuous effort that helps organizations meet rules and regulations while building trust with customers and regulators. Clear records and effective processes are essential for success.

A strong compliance system improves daily operations and supports smooth audits. Keeping policies updated and staff informed is key in a changing regulatory landscape.

Of course, compliance management comes with a set of challenges. However, by selecting the right tools, like Modern Requirements4DevOps for compliance management, you can always be ready to face those challenges.

Frequently Asked Questions (FAQs)

1. What are the three types of compliance?

Three types of compliance include:

- Regulatory compliance (adhering to laws and external rules)

- Corporate compliance (following company policies)

- Internal compliance (maintaining everyday standards).

These types of compliance are essential to manage in regulated industries.

2. What are the 5 keys to compliance?

The 5 keys of compliance are:

- Clear policies

- Regular training

- Thorough documentation

- Continuous monitoring

- Periodic audits.

These keys are vital for effective compliance tracking best practices.

3. How do compliance tracking best practices help organizations?

They ensure secure, end-to-end traceability for compliance, making it easier to spot issues early. Regulatory compliance software supports these efforts by automating record-keeping.

4. What are compliance risk management tools?

These tools assess and monitor risks to prevent non-compliance issues like fines, suspension of license, etc. They are important for maintaining audit-ready compliance management.

5. How does Modern Requirements4DevOps address compliance in highly regulated industries?

Modern Requirements4DevOps offers features like smart reports, Copilot4DevOps, and other features to automate compliance management to streamline processes.